T. Kulteleev 10 questions to a lawyer about post-registration actions in the Astana International Financial Centre // Zakon.kz - 2024.10.10

Once a company has been set up, obtained a license and commenced carrying out its activities, it will inevitably encounter such post-registration issues as the change of address, director, increase or reduction of the share capital, change of a shareholder, beneficial owner, obtainment of abstracts from the register, or registration of pledge. Many of us have the experience of implementing such procedures using the example of a limited liability partnership ("LLP") in the general jurisdiction of the Republic of Kazakhstan ("Kazakhstan"). We do hope that our readers would be interested in learning the practical nuances of similar actions drawing on the example of private companies in the Astana International Financial Centre ("AIFC"), getting relevant information on the key trends and practical lifehacks.

1. Information about what changes must be provided to the AIFC Registrar?

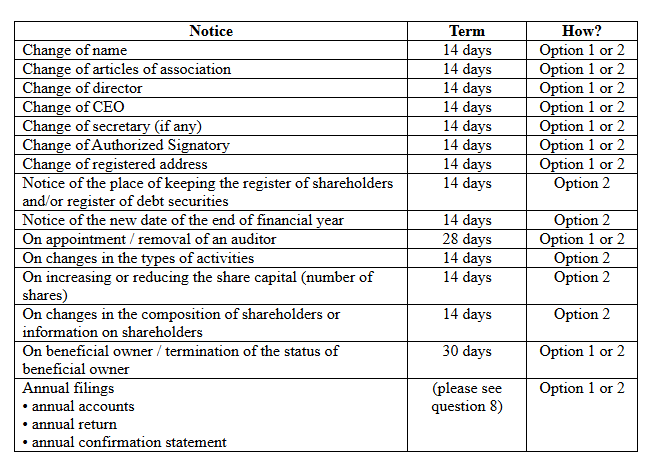

The AIFC acts regulating the corporate issues are the Companies Regulations ("Regulations") [1] and the Companies Rules ("Rules") [2]. According to the Guidance on Filing Obligations of AIFC Participants to the Registrar [3] ("Registrar"), it is necessary to inform of the changes set out in the table. If previously it had been possible to send notices by post to the AFSA Post-Registration Division, starting 1 April 2024, any notices must be filed only on the e-Residence (www.digitalresident.kz) portal by two methods: Option 1: by using an automated service (Log in Section); Option 2: by sending scan copies (Submit paper forms Section).

Violation of the said requirements is punished by a fine in the amount of up to USD 10,000 (Schedule 3 of the Rules); however, the Guidance on Filing Obligations of AIFC Participants to the Registrar [4] specifies that the fine is up to USD 2,000. An application is signed by an electronic digital signature of a director / CEO, Authorized Person [5] or Authorized Signatory, or the company Secretary. If the application is filed by an attorney-in-fact, it may only be filed on paper (option 2 above). In the first case, the Registrar's fee will be USD 50, in the second one – USD 100 [6]. An invoice is generated online. According to the post-registration section of the AIFC website [7], the time required to process an online application is 1-5 days, offline application – 7-10 days. This website also offers all possible forms of notices and even samples of certain documents. In most cases, the notice must be accompanied by a respective resolution, Ordinary or Special [8], as required by the articles of association and/or Regulations, and must attach the supporting documents (e.g. lease agreement in case of changing the registered address, articles of association in case of changing the articles of association, document on share transfer in case of changes in the shareholders). The article by T. Kulteleev "10 questions to a lawyer about a director and the CEO in the AIFC" has already considered the procedure for notifying the Registrar of the change of a director and the CEO. Other cases will be considered in more detail in the following questions.

2. What are the cases of changing a company shareholder?

Changes in the composition of shareholders in a private company may occur due to different reasons. Below we will consider the most common cases.

2.1. Sale and purchase of shares

The most common reason is the sale of shares by one shareholder to another person. In this case, the parties enter into an agreement on sale and purchase of shares (Share Purchase Agreement / SPA). Unlike an LLP, the AIFC acts do not require that such agreement be notarized if one of the parties is a natural person. However, the specific feature is that the Registrar does not request for submission of the very sale and purchase agreement, but it is necessary to submit the so-called Instrument of Transfer [9] (which is a simple form of the expressed consent to the sale and purchase of shares). It is possible to draw an analogy with the transactions involving shares of joint stock companies ("JSC") and participatory interests in LLPs whose register of participants is kept by the Central Depository ("Central Depository") where such document is represented by an order on withdrawal and crediting of shares/participatory interests. Same as the Central Depository, the Registrar does not request for the SPA; however, unlike the Central Depository, it is not necessary to open a personal account with the Registrar. As regards the laws applicable to the agreement, the parties may select any laws, including the laws of England and Wales, for the reasons, as follows: (i) Section 43 of the Regulations on AIFC acts [10] allows for selection of the laws applicable to agreements by agreement of the parties and establishes that the laws selected by the parties must be binding upon such parties; (ii) AIFC has its own regulation with respect to companies, specifically, the Regulations and the Rules; (iii) according to the AIFC Constitutional Law, the current laws of Kazakhstan apply to the extent not regulated by the Constitutional Law and the AIFC acts [11]; therefore, provisions of Article 1114 of the Civil Code [12] stating that "relations involving setting up and termination of a legal entity, transfer of a participatory interest therein and other relations between the participants of the legal entity relating to their mutual rights and obligations must be regulated by the laws of the country where such legal entity has been incorporated" should be disregarded; (iv) Kazakhstan legislation uses the concept of "participatory interest" only with respect to economic partnerships [13]. The concept of "participatory interest" is not used with respect to companies and the concept used for companies is "shares". In addition, it is necessary to obtain the following documents before the transaction or the Closing Date: (i) consents from spouses of natural persons [14] to enter into the SPA and/or corporate approval for legal entities; (ii) certificate of absence of encumbrances; (iii) if necessary, obtain consent of the antitrust agency to economic concentration [15] (in case of purchasing more than 50% of shares, if the aggregate balance sheet value of assets of the purchaser (group of persons) and the company, or their total volume of sold goods for the past financial year exceeds 10,000,000 MCI [16]); (iv) if necessary, obtain a record number from the National Bank if a party to an agreement is a non-resident and the purchase price exceeds USD 500,000 (record number must be obtained before the money transfer, otherwise, the money will get locked up on a transit bank account, and before notifying the Registrar, because the record number must be obtained before performance of an agreement and, in this case, change of a shareholder in a Public Register is the performance under the agreement [17]; and (v) other documents according to the conditions precedent.

2.2. Reorganization or death of a shareholder

The composition of shareholders may change in connection with reorganization of one of the shareholders in a situation where, based on an act of an authorized agency (e.g. judicial authority), a legal entity acting as a shareholder ceases to exist and all rights to shares transfer to a legal successor, or in connection with death of a shareholder who is a natural person, based on a certificate entitling to inherit property, rights to shares transfer to heirs. Furthermore, the Registrar must be notified in case of changes in the name / full name of a shareholder.

2.3. Admission of a new shareholder to the composition of shareholders (issue of new shares)

The third example of changing the composition of shareholders is a situation where a new shareholder is admitted to the composition of shareholders by way of issuing new shares. In the AIFC, this process happens the following way. As a rule, the parties enter into a Framework Investment Agreement ("FIA"), whereby the current shareholders, company and investor agree upon the issue of new shares or purchase of already issued shares, unless they have been distributed; conditions of issuing and investing money in the company; rights and obligations, representations and warranties; liability of the initial shareholders and the investor; procedure for the company's operations during the transition period up to the Closing Date; Conditions Precedent and the Closing Procedure, as well as the Post-Closing Duties, including agree upon the draft of the new articles of association, shareholders agreement, subscription agreement, and other conditions/documents. As per the laws applicable to the agreement, the parties may select any laws, including the laws of England and Wales. The parties must provide each other with the documents stipulated by the conditions precedent by the Closing Date, for example (i) resolution of the Board of Directors of the company to issue new shares (Section 44(5) of the Regulations); (ii) waiver of the current shareholders of the pre-emptive purchase right to the new shares (Section 48); consents of spouses of shareholders to enter into the FIA and/or corporate approval for legal entities. If necessary, the parties obtain the antitrust agency's consent to economic concentration and/or record number of the National Bank in case the investor is a non-resident and the investment amount exceeds USD 500,000. The closing procedure is conducted as follows: (i) company and investor sign the subscription agreement and other documents required to finish distribution of shares, for example, the instrument of transfer; (ii) company issues a certificate for shares to the new shareholder (investor); (iii) company notifies the Registrar of changes in the composition of shareholders (including if the register is kept by the Registrar); (iv) company notifies the Registrar of the change of the beneficial owner (in case of such change); (v) company, initial shareholders and investor sign the shareholders agreement; (vi) parties sign the closing certificate confirming the performance of all obligations and closing of the transaction. Then the investor transfers the amount of investments to the company's account. Admission of a new shareholder results in re-calculation of the ownership percentage (%) of shares in case of issuing additional shares of the same class. The initial shareholders may distribute shares based on the nominal value. However, when issuing additional shares of the same nominal value and their distribution in favor of the investor pursuant to the subscription agreement, the investor must pay not the nominal value but the value determined in such agreement and the FIA. This is to say that the initial shareholders pay the nominal value of shares, but investor pays the market value agreed upon by the parties (i.e. investor's monetary contribution may be unequal to the share's nominal value). A similar process of admission of a new participant by increasing the share capital (Articles 43.2.1) and 26.2.5) of the LLPs Law) and relevant procedure for re-calculation of the participants' shares (Article 26.4 of the LLPs Law) also exist for the LLPs. The participants may re-calculate the shares providing in the articles of incorporation for a different distribution of shares, which will not depend on the participants' contributions (Article 23.6 of the LLPs Law).

2.4. Entering the company's shares in the books of balance of another legal entity

Another instance is the entering of the company's shares owned by a shareholder as a contribution to the share capital of another legal entity resulting in a situation where the legal entity, to which the company's shares have been transferred as a contribution to the share capital, becomes a new shareholder. As you may know, a contribution to the share capital may be made not only in the form of money, but property as well. In case of an LLP, to transfer property as a contribution to the share capital, such property must be evaluated in the monetary form upon an agreement of all founders (participants). If the value of such contribution exceeds the amount equal to 20,000 MCI, its evaluation must be confirmed by an appraiser (Article 23.4 of the LLPs Law [18]). Thus, if the company's shares are contributed to the LLP's share capital, the LLP becomes a company shareholder, and the shareholder that transferred its shares to the LLP's share capital accordingly becomes a participant of such LLP. The final stage of transfer is the signing of a transfer and acceptance certificate and sending of information regarding the new shareholder to the Registrar. The AIFC companies have a similar procedure. Thus, for example, property may be transferred to a company in exchange for shares. The AIFC acts do not require appraiser's confirmation of the value of the property contributed in exchange for shares. Instead, according to Section 45(2) of the Regulations, the Board of Directors of the company must: a) determine the reasonable cash value of the consideration for the shares; b) resolve that, in its opinion, the consideration for the shares is fair and reasonable to the company and to all existing shareholders; c) resolve that, in its opinion, the present cash value of the consideration to be provided for the shares is not less than the nominal value to be credited for the issue of the shares; and d) submit a copy of the relevant resolutions to the Registrar along with the notice of the allotment. Then it is necessary to sign a transfer and acceptance certificate for the shareholder's property entered in the books of balance of the company as payment for the issued shares and based on the above resolution of the Board of Directors. If a participatory interest in an LLP is contributed as payment for shares, such certificate must be notarized. According to Article 14.6 of the State Registration Law [19] "an agreement on alienation (assignment) of rights of an outgoing participant of an economic partnership to a share in property (share capital) of a partnership or any part thereof, a party to which is a natural person, shall be notarized". According to the registration authority (Government for Citizens NJSC), this provision covers not only agreements, but also any other documents, including share transfer certificates. Prior to signing the certificate, it is necessary to uphold the pre-emptive purchase right and obtain waivers from all participants and the LLP, and consents of spouses to alienation of the participatory interest. However, same as in case of sale and purchase, the Registrar does not request for submission of the very transfer and acceptance certificate for entering in the books of balance, but it is necessary to submit the so-called instrument of transfer in accordance with the established form. The next step after signing the transfer and acceptance certificate will be the LLP re-registration in connection with changes in the composition of participants in order to reflect in the National Register of Business Identification Numbers (or as they say in egov) the AIFC company as the LLP participant. For this purpose, the general meeting of the LLP participants passes a resolution on re-registration and introduction of amendments into the constitutional documents of the LLP (Article 37-1 of the LLPs Law). Then the company director signs the amendments to the LLP's articles of association (not necessary to notarize), and the articles of incorporation of the LLP lose force in connection with the fact that the LLP will have one participant. In this answer, we do not consider other potential instances of changes in the composition of shareholders, for example, in connection with re-organization, etc.

3. How will notification of the registrar of the change of shareholder happen, and will this entail re-registration?

According to the Regulations, the register of shareholders may be kept either by the company itself, or by the Registrar (Section 52(1) of the Regulations) [20]. In case of changes in the composition of shareholders, the company must notify the Registrar within 14 days (Section 52(14) of the Regulations).

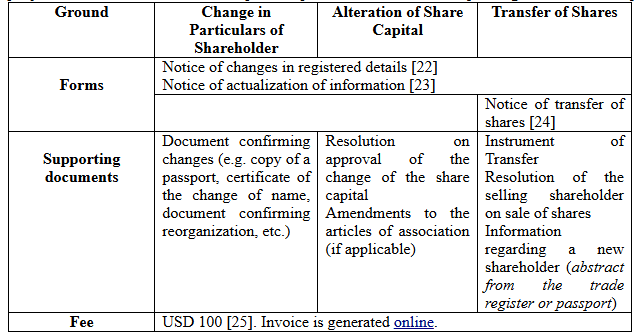

A notice consists of the following documents, which must be signed by the company director and attached as scan copies or uploaded to the website, depending on the selected option [21].

The Registrar may be concurrently notified of several changes (e.g. change of shareholder, amendments to the articles of association, change of director and address). The fee for processing the notice will in any case be one. However, each notification action must be accompanied by a relevant form of a notice, which forms are available on the website [26]. There are no service provision standards relating to the change of a shareholder in the AIFC; therefore, the Registrar may generally request for any documents and information, which it deems necessary. For example, after receiving the full set of documents, the Registrar verifies them and may request for additional documents (e.g. corporate ownership scheme and/or documents on each legal entity up to the beneficial owner for which the passport is submitted), as well as those, which may be requested as part of the Strategic Fit Process (for details, please see the articles by T. Kulteleev "10 questions to a lawyer about registration of companies in the AIFC" and "10 questions to a lawyer about redomiciliation of companies to the AIFC"), such as a legal opinion on the impact of sanctions. After satisfying all requirements of the Registrar, it will introduce data into the AIFC Public Register [27]. According to the Regulations, a ground for the company re-registration is only conversion of a private company into a public one and vice versa (Sections 39, 40). Change of shareholders does not entail re-registration in the AIFC; however, since it is necessary to attach an application concurrently with the notice, the Registrar will send it to the justice authority via its channels to update information in the National Register of Business Identification Numbers [28], and the latter will, in turn, update information by way of re-registration of the company. In addition, once a year, when submitting the Annual Return, the company submits information to the Registrar regarding the shareholders.

4. Is it necessary to introduce amendments into the articles of association and the shareholders agreement?

First of all, it is worth mentioning that, when setting up and registering a company, the parties sign a resolution on setting up of a private company and the articles of association.

The requirements to the content of the articles of association are set out in Section 2.2.2 of the Regulations and allow for inclusion of any provisions in the articles of association, including those relating to the procedure for passing resolutions (Section 14(3), Section 75(1), Section 98).

The exclusive competence of the supreme body is not set out in a single Article and the matters referred to the supreme body's competence may be determined in the articles of association.

Furthermore, the Regulations stipulate that the following resolutions must be executed by a Special Resolution:

• amendment of the articles of association – Section 19(1);

• change of the company name – Section 22(1);

• re-registration as a public company – Section 40(1);

• purchase of own shares – Section 61(2);

• reduction of the share capital – Section 64(1).

According to the Rules, the following issues must be approved by a Special Resolution:

• conversion into an investment company – Section 6.3.1;

• conversion into a protected cell company [29] – Section 8.3.1.

the Standard Articles of Association of the AIFC contain the following references to a Special Resolution:

• for these Articles, if an Ordinary Resolution is expressed to be required for any purpose, then, subject to the Companies Regulations, a Special Resolution is also effective for that purpose - Article 1.9.;

• shareholders may, by Special Resolution, direct the Directors to take, or refrain from taking, specified action – Article 19.;

• articles of association may be amended by Special Resolution – Article 30.

The shareholders may select the standard articles of association [30] or approve the bespoke articles of association. In this case, the articles of association must set out the competence of the managing bodes, including procedure for convening and holding meetings, and passing resolutions, and determine the issues referred to the competence of shareholders (Shareholders Reserved Matters) and the Board of Directors (Board Reserved Matters).

Furthermore, it is necessary to describe in detail the powers of the CEO, because the AIFC acts almost do not provide for the CEO's competence.

The articles of association are approved at the meeting of founders and signed by a person determined in a Special Resolution of shareholders. It is not necessary to notarize the articles of association.

The shareholders may enter into the shareholders agreement at their own discretion, determining the rights and duties of the shareholders, including on withdrawal from the company, preemptive purchase right; structure of the company's management bodies; procedure for appointment of directors and the CEO; procedure for referring issues to the competence of certain bodies (these issues must be duplicated in the articles of association or there must be a reference to the shareholders agreement); procedure for joining of the new shareholders; ways to resolve deadlock situations, as well as securing different instruments, including put option, call option, tag alone, drag alone, etc. As regards the laws applicable to the agreement, the parties may select any laws as the governing law, including the laws of England and Wales.

The shareholders agreement is not a mandatory document as compared with an LLP where the participants must enter into the articles of incorporation (the exception is the LLPs keeping the register of participants in the Central Depository). As per the JSCs, the effect of the articles of incorporation ceases from the date of state registration of the issuance of authorized shares [31].

In case of changes in the composition of shareholders, according to the general rule, it is not necessary to amend the articles of association (unless the articles of association contain information on the shareholders). However, in case of increasing the share capital, it will be necessary to amend the articles of association and notify the Registrar.

If the shareholders enter into the shareholders agreement at a later date or at the stage when a new investor (new shareholders) enter a company, as a rule, it becomes necessary to accordingly amend the articles of association.

It is not necessary to notify the Registrar of the fact of entering into or amending the shareholders agreement. However, the Registrar must be notified of the amendments introduced into the articles of association within 14 days (Section 19(2) of the Regulations).

A director must sign a notice of amendment of the articles of association [32] and attach a copy of the articles of association and the Special Resolution of the shareholders on approval of the articles of association, including a certificate issued at least by one of directors of the company, which must confirm that the proposed amendment is in line with requirements of the Regulations and the Rules. It is important to remember that, according to Section 28 of the Regulations "Filing of Special Resolutions and certain other Resolutions and agreements affecting a Company's Constitutional Documents", the company must submit a signed copy of each resolution or agreement within 15 days after the date of it is passed or entered into. Violation of this requirement is punished by a fine in the amount of up to USD 5,000. Analysis of this paragraph and definition of the term "constitutional documents" set out in paragraph 4 of Schedule 1 of the Regulations allows us making a conclusion that the shareholders agreement is not referred to constitutional documents, because such agreement is not approved by any resolution of a company.

5. Is it necessary to notify the Registrar of the change of a beneficial owner?

As a rule, changes in the composition of shareholders entail the change of a beneficial owner. Beneficial owner is a natural person holding directly or indirectly more than 25% of shares of a company and voting rights, and exercising control and significant influence on the company's activities (please see the full definition in Section 179-1(1) of the Regulations and the AIFC Guidance on Ultimate Beneficial Owner [33]). Unlike the AML/CFT Law [34], the Regulations set out the exhaustive description of the beneficial owner and the methods allowing to determine the beneficial owner (including partnerships, trusts, funds, and other structures). In cases where the beneficial owner cannot be determined based on these criteria, each natural person who is a member of its managing body and the ultimate beneficial owner of the legal entity that is a member of its managing body are considered as the ultimate beneficial owners of the relevant person. A similar provision is contained in Article 6.3.2-2) of the AML/CFT Law. The company must keep and maintain the Register of beneficial owners or transfer the keeping of such register to the Registrar (as a rule, this is decided at the stage of the company registration) and notify it of all changes within 14 days (paragraphs 1, 8, 9, 19, 22 of Section 179-4 of the Regulations); however, the AIFC Guidance on Ultimate Beneficial Owner and the Guidance on Filing Obligations of AIFC Participants to the Registrar specify another term of 30 days. Furthermore, once a year, when submitting the annual return, the company provides the Registrar with information on beneficial owners. A notice is composed of the following documents (must be attached as scan copies or uploaded to the website, depending on the selected option): a) notice to the AIFC of changes in the registered details [35]; b) information on beneficial ownership [36]; c) notice of ceasing to be a beneficial owner [37] (if applicable); d) document confirming changes in specific details of the ultimate beneficial owner (passport, ID card, certificate of the change of name); e) confirmation of payment. The beneficial owner is not disclosed in a public register. In 2023, the AML/CFT Law was amended in the general jurisdiction of Kazakhstan, which introduced the register of beneficial owners of legal entities kept by an authorized agency (Article 6-1). Legal entities and foreign structures without formation of a legal entity must take available measures to identify their beneficial owners and record information required to identify them (Article 12-3). Furthermore, starting 2020, Kazakhstan introduced the new forms of applications for the state registration of legal entities [38] providing for indication of information on the beneficial owners. 2023 marked the entry into force of a rule of the State Registration Law, which obligates to change the registration details of a legal entity if its beneficial owner changes (Article 14-2.8).

6. How can the share capital be changed (increased)?

The company's share capital may be increased in accordance with the procedure determined by Section 44 of the Regulations (Alteration of share capital). A company may: a) increase its share capital by creating new shares of an existing class with the same nominal value, or a new class of shares of the nominal value it considers appropriate. Let us assume that the company has shares of class A with the nominal value of USD 10. The company decides to increase its share capital by creating new shares. This is how this may be implemented in practice:

- Creation of new shares of an existing class:

- The company initially has 1,000 shares of class A with the nominal value of USD 10.

- The company additionally issues 500 shares of class A with the nominal value of USD 10.

- New the company has 1,500 shares of class A with the nominal value of USD 10 each.

- The total share capital is increased for USD 5,000 (500 new shares * USD 10).

- Creation of new shares of a new class:

- The company initially has 1,000 shares of class A with the nominal value of USD 10.

- The company decides to create shares of a new class — class B with the nominal value of USD

- The company issues 2,000 shares of class B with the nominal value of USD 5.

- Now the company has 1,000 shares of class A with the nominal value of USD 10 and 2,000 shares of class B with the nominal value of USD 5.

- The total share capital is increased for USD 10,000 (2,000 new shares of class B * USD 5). Issuance of shares of another class may be conditioned by the necessity to provide a specific shareholder with a voting right on certain issues, receive fixed dividends or have the priority right to receive a part of the company's property in case of liquidation, etc.

b) consolidate and divide its share capital (whether allotted or not) into shares representing a larger nominal value than their existing nominal value; Let us assume that the company has 100 shares with the nominal value of USD 1 each. The company decides to consolidate and divide its share capital in a manner to increase the nominal value of the shares. This is how this may be implemented in practice:

- Initial shares:

- number of shares: 100

- nominal value of each share: USD 1

- total share capital: USD 100

- After consolidation and division:

- The company decides to unite shares in a manner that each new share has the nominal value of USD 2.

- For this purpose, each 2 old shares are united into a new share.

- New shares:

- number of shares: 50 (each 2 old shares are united into a new share)

- nominal value of each new share: USD 2

- total share capital: USD 100 (remains the same). Thus, following consolidation and division the number of shares becomes lesser, but their nominal value becomes greater and the total share capital of the company remains the same. This allows the company to change the nominal value of its shares, increasing their nominal value, which may be helpful for different corporate strategies, for example, to simplify the structure of the share capital or change the market perception of the value of shares. c) subdivide its shares, or any of them, into shares representing a smaller nominal value than their existing nominal value, if the proportion between the amount paid and the amount unpaid (if any) on each subdivided share is the same as it was for the share from which the subdivided share was derived. Let us assume that the company has a share with the nominal value of USD 10. This is a fully paid share. The company decides to subdivide this share into 2 shares with the nominal value of USD 5 each. This is how this may be implemented in practice:

- Initial share:

- nominal value: USD 10

- paid amount: USD 10

- unpaid amount: USD 0

- Subdivided shares:

- number of shares: 2

- nominal value of each share: USD 5

- amount paid for each share: USD 5

- amount unpaid for each share: USD 0 The proportion between the paid and unpaid amounts remains the same, since each new share with the nominal value of USD 5 is fully paid in the same manner as the initial share with the nominal value of USD 10. The Company may change its share capital by passing a resolution, unless such change is prohibited by the Company's articles of association or results in a situation where the Company’s share capital becomes lower than the minimum amount (Section 44 of the Regulations), in case such minimum share capital is stipulated for the regulated type of activities. The Regulations are silent as to which resolution (Ordinary or Special) must be used to execute such decision. According to the Standard Articles of Association of a private company, a decision to increase the share capital is executed by passing an Ordinary Resolution of shareholders, unless otherwise stipulated by the Regulations (Article 11 of Schedule 5 of the Rules). However, a resolution to increase the share capital by making a non-monetary contribution is passed following a resolution of the Board of Directors of the company (Section 44 of the Regulations). In this case, when distributing shares, the current shareholders will have the pre-emptive purchase right to third parties (Section 48 of the Regulations). Unless otherwise determined by the articles of association, the right to decide on behalf of the company to allot and issue shares and grant the rights for subscription (subject to the shareholders' pre-emptive rights) belongs to the Board of Directors of the company (Section 44(5), 48 of the Regulations). It is worth mentioning that a company may not change the share capital if (i) this is prohibited by the articles of association of the company; (ii) if changes in the share capital will result in reduction of the capital below the allowed level stipulated by prudential rules for companies carrying out financial activities. Please also see our answer to question 1 (procedure, terms) and question 3 (Alteration of Share Capital).

7. How can the share capital be reduced?

The share capital of a company may be reduced in accordance with the procedure determined by Chapter 7 of the Regulations (Reduction of Share Capital).

-

Appointed Publications [39]. A notice must be published no more than 30 days and at least 15 days prior to the date of entry into force of a resolution on reduction of the share capital. The notice must be accompanied by a solvency statement signed by each company director. Section 65 of the Regulations determines the content of the said notice and the solvency statement [40].

-

Passing a Special Resolution on the issue of reduction of the share capital and approval of amendments to the articles of association.

-

Signing of amendments to the articles of association. Please see question 4.

-

Notification of the Registrar. For the terms and procedure, please see question 1.

The following documents must be submitted to the Registrar of Companies: • special resolution; • copy of a notice to mass media; • solvency statement; • details on classes of shareholders and share capital [41]; • notice of change in registered details [42]; • notice of actualization of information [43]; • documents on amendment of the articles of association (please see question 4); • document on payment of the AIFC fee (please see question 1). -

Updating the registered details in the Public Register. The Registrar processes documents and introduces information regarding the reduction of the share capital into the Public Register, and transfers information to the Ministry of Justice of Kazakhstan for introduction of changes into the National Register of Business Identification Numbers.

The evidence of successful registration of the reduction of the share capital will be published information in the Public Register. Furthermore, an applicant and any person may obtain a certificate of the last registration actions on the portal of electronic Government. Please note that the company may not reduce its share capital if (i) this is prohibited by the articles of association of the company; (ii) reduction of the share capital and redemption of shares will result in the absence of shareholders; (iii) reduction of the share capital results in reduction of the capital below the allowed threshold stipulated by prudential rules for the companies carrying out financial activities.

8. What are the mandatory types of reporting to be submitted by a company?

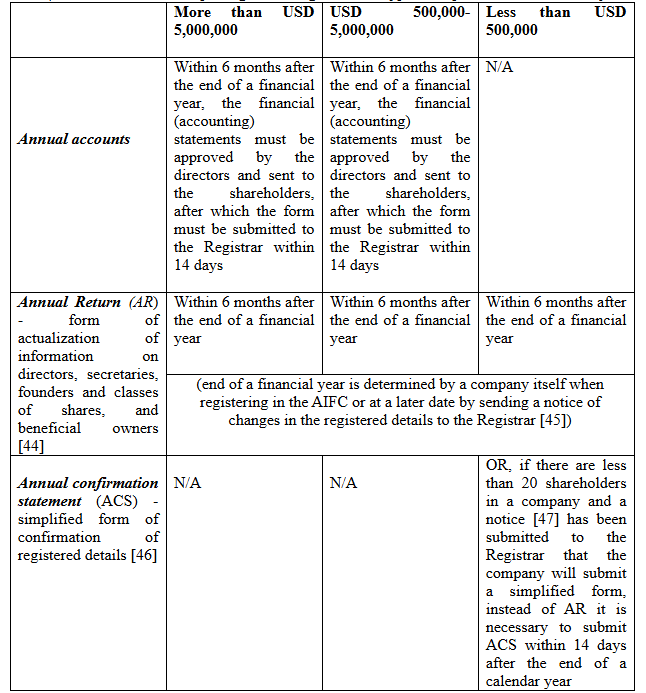

Each company registered in the AIFC (whether carrying out regulated activities or not) must submit annual reporting to the Registrar. The types of reports to be submitted by the company depend on the company's annual turnover.

Unless otherwise provided for by the company's articles of association, a private company and its directors must not organize audit of financial statements and submit it to the Registrar, provided that the following conditions are met during the current year, for which the statements are drafted, and within a year preceding such financial year if the company exists for more than 1 year: • annual turnover does not exceed USD 5,000,000; and • average number of shareholders does not exceed 20 persons. For more information on the obligations of the AIFC participants, please see the Regulations (Section 26) and the Guidance on Filing Obligations of AIFC Participants to the Registrar [48]. The reporting is submitted by two ways: • via the e-Residence portal – fee of USD 10 [49]. • to email monitoring@afsa.kz – fee of USD 20. Violation of requirements on submission of the annual reporting is punished by a fine in the amount of up to USD 10,000 [50]. In case of late submission of reporting, an increased fee of USD 300 will be charged for untimely submission of reporting if a company fails to fulfil the instructions issued by AFSA within 3 business days after such violation. Failure to pay the fine within 30 calendar days entails an additional fine for late payment in the amount of 10% of the amount of fine for each calendar day [51]. According to Section 167 of the Regulations, the Registrar may strike the company's name off the register if the Registrar has reasons to believe that: (a) company is not conducting business or is not in operation; (b) company is contravening the Regulations; or (c) it is prejudicial to the interests of the AIFC for the Company to remain in the Register. The Registrar of companies may conclude that the company is not conducting business or is not in operation where the annual return or the annual confirmation statement of the company has not been filed by the relevant date or a fee due to the Registrar has not been paid on the date due (Section 167(1-1) of the Regulations). Among other types of reporting, it is worth mentioning that the AIFC participants must submit information on the engaged foreigners and stateless persons to the AIFC Authority [52]. Furthermore, it is important to keep in mind that the tax regime in the AIFC territory is determined by the Tax Code of Kazakhstan save for the exceptions established by Article 6 of the AIFC Constitutional Law, which means that tax obligations of a taxpayer, including submission of reporting by a company, must be performed in accordance with the Tax Code of Kazakhstan. The current laws of Kazakhstan apply to the extent not regulated by the AIFC Constitutional Law and the AIFC acts (Article 4.1.3 of the AIFC Constitutional Law), which means that the company must submit all other types of reporting not regulated by the AIFC acts. For example, such types of reporting include primary statistical reporting [53]; reporting on performance of a currency contract [54]; reporting submitted to the migration authority on the engaged foreign labor [55], etc.).

9. How can we obtain an abstract from a public register?

The e-Residence portal allows filing applications for the following documents: • abstract from a public register; • copy of the minutes of election of the Board of Directors; • abstract from the register of shareholders; • information abstract from the register of secretaries; • information abstract from the register of ultimate beneficial owners; • copy of a certificate of good standing. We previously mentioned in our answer to question 1 that there is an automated service regime (Section "Log in") and the offline regime (Section "Submit paper forms"). The fee for processing the documents in the automated regime is USD 20 (issued are electronic documents with a QR code) or USD 40 in case of an offline application followed by the issuance of a response on paper bearing the signature and seal of the Registrar. It is worth mentioning that, since the Registrar is not a governmental authority, the documents obtained from the Registrar cannot be apostilled. For this purpose, it is necessary to either draft a notarized copy, which may be later apostilled, or apply to the justice authority for an abstract from the National Register of Business Identification Numbers containing information similar to those published in the Public Register.

10. How can we register pledge over the company's shares?

The AIFC acts regulating corporate issues include the Security Regulations ("Security Regulations") [56] and the Security Rules ("Security Rules") [57]. The AIFC laws distinguish the institute of collateral as a separate security interest, which must be registered in the form of a relevant security agreement in the AIFC. Such security agreements serve as an additional protection for a creditor, granting a guarantee of performance of obligations by the borrower. The AIFC acts provide for priority of secured creditors in case of default of a debtor and procedure for the sale of property. Collateral may be represented by different movable property, including shares and participatory interests in companies, securities, except for any personal property, accounts receivable, deposit account, document of title, negotiable instrument, financial property, and money, including rights to claims and intellectual property rights (for these and other terms and definitions used in this answer, please see paragraph 7 of Schedule 1 of the Security Regulations). In the AIFC, the Security Registrar deals with registration of collateral [58]. The Security Registrar keeps a special collateral register with information about the collateral. Procedure for registration of collateral: (a) To fill out the Financing Statement Form. The requirements to the form are contained in Section 3.3 of the Security Rules. It is necessary to be sure that the collateral is described in accordance with a security agreement and the Form is signed and submitted by a secured party, a person in whose favor a security interest is created or stipulated by the security agreement. (b) To pay a relevant fee. The fee is USD 1 for each USD 1,000 of the collateral value specified in the Financing Statement Form (but not less than USD 250 and no more than USD 5,000) [59]. (c) To send the signed Financing Statement Form to the email of the Security Registrar. (d) Once the Security Registrar processes the request, the collateral will be assigned a unique number and the party will be provided with a letter of confirmation. The acts do not contain any term, during which the Security Registrar must consider the Financing Statement Form. The Security Registrar may make the inquiries and have regard to anything else the Security Registrar considers appropriate (Section 3.7.5 of the Security Rules). The Security Registrar accepts different types of security agreements, including a share pledge agreement; account pledge agreement; general assignment agreement; collateral agreement; deed of charge; security agreement. The collateral registered with the Registrar using the Financing Statement Form remains in force within 5 years of the date of registration. If you wish to extend it after this period, please contact the Security Registrar Office for further instructions. It is worth mentioning that submission of false or misleading information to the Security Registrar entails the maximum fine in the amount of USD 5,000 [60]. Procedure for conducting a search in the collateral register. It is possible to ask the Security Registrar to provide information on registered encumbrances. This information is required for due diligence of transactions, such as sale and purchase, procurement of credits, merger and acquisition of companies. For example, when searching for a specific company, section "capital" of the public register contains a filed "Collateral Information". We believe that information on the pledge of shares of a company registered in the AIFC must be reflected in this Section. Furthermore, any person may file an inquiry by sending it to the email of the Security Registrar and specifying IIN/BIN of a debtor, paying a fee of USD 50 for each request (Section 4.1.3 of the Security Rules). Normally, the time required to process a search request is 2-3 business days.

[1] AIFC Companies Regulations No. 2 dated 20 December 2017 (amended as of 28 December 2022, in effect since 1 January 2023). [2] AIFC Companies Rules No. GR0004 dated 29 December 2017 (amended as of 17 October 2021, in effect since 1 January 2022). [3] Guidance on Filing Obligations of AIFC Participants to the Registrar. [4] Guidance on Filing Obligations of AIFC Participants to the Registrar. [5] In this article, we use the terms of the AIFC acts. To see the meaning of the terms, please refer to the AIFC Glossary No. FR0017 dated 29 April 2018 (amended as of 9 December 2022, in effect since 1 January 2023). [6] Schedule 5-1 to the AIFC Fees Rules (fees) No. FR0007 dated 10 December 2017 (amended as of 9 December 2022, in effect since 1 January 2024) ("Fees Rules"). [7] AIFC Post-Registration Division: https://afsa.aifc.kz/en/post-registration. [8] According to Section 4 of Schedule 1 to the Regulations, an Ordinary Resolution of a company means a resolution passed by a simple majority of the votes of the shareholders (or the shareholders of the relevant class of shares) who vote in person or, if proxies are allowed, by proxy…// Special Resolution of a company means a resolution passed by at least 75% of the votes of the shareholders (or the shareholders of the relevant class of shares) who vote in person or, if proxies are allowed, by proxy. [9] Please see the sample Instrument of Transfer of Shares. [10] Regulations on AIFC Acts No. 1 dated 20 December 2017 (amended as of 12 July 2019, in effect since 1 July 2019). [11] Constitutional Law No. 438-V of the Republic of Kazakhstan "On the Astana International Financial Centre" dated 7 December 2015 ("AIFC Constitutional Law"). [12] Civil Code No. 409 of the Republic of Kazakhstan (Special Part) dated 1 July 1999 (amended as of 16 May 2024) ("Civil Code"). [13] Economic partnerships may be set up in the form of a full partnership, commandite partnership, limited liability partnership, and additional liability partnership (Article 1.2 of the Law No. 2255 of the Republic of Kazakhstan "On Economic Partnerships" dated 2 May 1995 (amended as of 8 June 2024). [14] Code No. 518-IV of the Republic of Kazakhstan "On Marriage (Matrimony) and Family" dated 26 December 2011 (amended as of 21 May 2024). [15] Entrepreneurial Code No. 375-V of the Republic of Kazakhstan dated 29 October 2015 (amended as of 8 June 2024). [16] Monthly calculation index (MCI) – starting 1 January 2024, 1 MCI is KZT 3,692. [17] Please see paragraph 9 of the Rules of monitoring over currency operations in the Republic of Kazakhstan, approved by the Resolution No. 64 of the Management Board of National Bank of Kazakhstan dated 10 April 2019 (amended as of 1 January 2024). [18] Law No. 220-1 of the Republic of Kazakhstan "On Limited and Additional Liability Partnerships" dated 22 April 1998 (amended as of 24 November 2021) ("LLPs Law"). [19] Law No. 2198 of the Republic of Kazakhstan "On State Registration of Legal Entities and Record Registration of Branches and Representative Offices" dated 17 April 1995 (amended as of 8 June 2024) ("State Registration Law"). [20] Please see the form of the AIFC Notice of place where Registers are kept on https://afsa.aifc.kz/en/post-registration. [21] Guidance on Filing Obligations of AIFC Participants to the Registrar. [22] Form of the AIFC Notification of Change in Registered Details. [23] Form of the AIFC Notification of actualization of information. [24] Form of the AIFC Notice of Transfer of Shares. [25] Schedule 5-1 of the Fees Rules. [26] AIFC Post-Registration Section: https://afsa.aifc.kz/en/post-registration. [27] AIFC Public Register: https://publicreg.myafsa.com. [28] Publicly available data on the website of the electronic Government. [29] Protected Cell Company, PCC is a special type of a legal entity allowing to set up separate "segments" or "cells" within one company. Each cell has its own assets and obligations separated from the assets and obligations of other cells and the common company (main company). [30] Standard Articles of Association of a private company (Schedule 5 to the Rules). [31] Law No. 415 of the Republic of Kazakhstan "On Joint Stock Companies" dated 13 May 2003 (amended as of 30 December 2022). [32] Form of the AIFC Notice of Amendment of Articles of Association. [33] AIFC Guidance on Ultimate Beneficial Owner. [34] Law No. 191-IV of the Republic of Kazakhstan "On Counteraction against Legalization (Laundering) of Illegally Gained Proceeds and Financing of Terrorism" dated 28 August 2009 (amended as of 8 June 2024) ("AML/CFT Law"). [35] Form of the AIFC Notification of Change in Registered Details. [36] Form of Details on beneficial ownership. [37] Form of the AIFC Notice of ceasing to be an UBO. [38] Rules of provision of the state service "State registration of legal entities, record registration of branches and representative offices", approved by the Order No. 66 of the Minister of Justice of the Republic of Kazakhstan dated 29 May 2020 (amended as of 13 July 2023). [39] Appointed Publications mean a notice or any other document if (а) it has been published on a website written in the English language, which is determined by the Registrar; or (b) it has been published in a newspaper common to the whole republic and issued in the English language in the Republic of Kazakhstan, and in a newspaper in a country where a relevant company or any other corporate body has its principle place of business. [40] Sample advertising on the website of Kazinform. [41] Form of Details on classes of Shareholders & Share Capital. [42] Form of the AIFC Notification of Change in Registered Details. [43] Form of the AIFC Notification of actualization of information (you can find all forms on the AIFC website in the Post-Registration Section). [44] Form of the AIFC Form for submission of Annual Return. [45] Form of the AIFC Notification of Change in the Registered Details. [46] Form of the AIFC Annual confirmation statement. [47] Form of the AIFC Election to file an Annual confirmation statement. [48] Guidance on Filing Obligations of AIFC Participants to the Registrar. [49] Schedule 5-2 of the Fees Rules. [50] Schedule 3 of the Rules and Guidance on Filing Obligations of AIFC Participants to the Registrar. [51] Schedule 10 of the Fees Rules. [52] Article 8 of the AIFC Constitutional Law. [53] Please see Article 17.2 of the Law No. 257-IV of the Republic of Kazakhstan "On State Statistics" dated 19 March 2010 (amended as of 8 June 2024). [54] Please see Article 14.1 of the Law No. 167-VІ of the Republic of Kazakhstan "On Currency Regulation and Currency Control" dated 2 July 2018 (amended as of 8 June 2024). [55] Please see Article 37-1.8 of the Law No. 477-IV of the Republic of Kazakhstan "On Population Migration" dated 22 July 2011 (amended as of 21 May 2024) ("Migration Law"). [56] AIFC Security Regulations No. 7 dated 20 December 2017 (amended as of 20 May 2024, in effect since 1 June 2024). [57] AIFC Security Rules (SR) No. 3 dated 8 October 2018. [58] Contacts of the Security Registrar can be found at https://aifc.kz/en/Contacts. [59] Schedule 1 of the Security Rules. [60] Schedule 2 of the Security Rules.